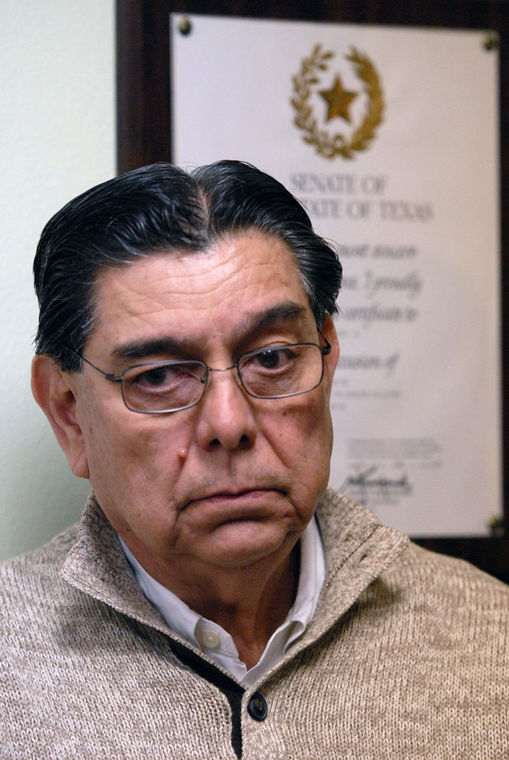

BROWNSVILLE — Cameron County Tax Assessor-Collector Tony Yzaguirre said the phone lines in his office are lighting up with two kinds of calls from tax payers as the year winds down.

County residents want to know whether they’ll be eligible for the 1-percent property tax discount for paying in December, and larger tax paying entities want to know whether they can pay next year’s property tax as well because of uncertainty about the impact of President Donald Trump’s tax reform.

For early bird property tax payers suffering anxiety over the New Year weekend, they should rest assured that tax offices will be open Tuesday, and the December property tax discount will be applied to all payments made by 5 p.m. that day.

Tax payers who mail payments will receive credit as long as it’s postmarked by Dec. 31. Payments made over the weekend and at drop-off boxes will also receive the discount.

“We still have approximately 79,149 that haven’t paid their accounts,” Yzaguirre said. “We started out with a little over 200,000 in tax payers and had a balance of 79,000 that are still outstanding, and I’m hoping that we’ll be able to collect the majority of the roll by Jan. 31.”

Tax payers have through Jan. 31 to pay property taxes and starting Feb. 1 all non-payments will become delinquent and penalties will be issued, Yzaguirre said.

Receiving that December property tax credit, however, is not the only pressing issue facing tax payers, particularly large property tax payers.

The demand by people and entities that pay larger amounts in property taxes to take care of 2018’s payment has been such that the tax office has set up special accounts to hold that payment for the next year.

“What we’re having to do, is we started that Monday, because of the phone calls, we opened up escrow accounts for people who want to pay those future taxes,” Yzaguirre said.

As he understands it, “their understanding of the new law is they are not going to be able to deduct anything over $10,000.”

The new regulations are contained in the Tax Cuts and Jobs Act that Trump signed right before the Christmas holiday.

According to the balance, a website that focuses on creating content that examines finances, that’s true. Taxpayers must choose between property, income or sales taxes when applying the up to $10,000 in state and local taxes deduction. Texas does not have income tax.

However, the driving factor behind the push also has a lot to do with uncertainty about tax reform, Yzaguirre said.

“That’s the understanding that we’re getting from the people, the individuals that have called. They don’t understand it right now, and it’s at the end of the year,” Yzaguirre said. “I think it was a rush-rush thing in the Congress and with the President as to how this thing is going to work. I think they’re coming forward and paying this just in case it’s not what they think.”

As for the average property tax payer, tax reform shouldn’t impact them.

“We’ve been telling individuals that normally if you paid $5,000 this year, normally, it should be the same (the next year) unless you added value to your property or the tax rate increased,” Yzaguirre said.

For those who are setting aside tax payments in escrow accounts at the tax office, it can’t yet be applied because the certified property tax roll won’t be prepared until next July.

“Next year, we’ll get that money and apply it,” Yzaguirre said.

And if funds in the escrow account don’t cover the payment, Yzaguirre’s office will send out a bill for the remaining amount.