With another tax season upon us, the United Way of Southern Cameron County is again throwing open the doors on its Volunteer Income Tax Assistance (VITA) sites offering tax-preparation assistance to filers with annual income below $58,000 and a simple tax return.

When the first of the VITA sites open starting Jan. 24, IRS-certified volunteers will be available to prepare and electronically file basic tax returns free of charge for qualified filers and also inform taxpayers about tax credits they might be eligible for — the Earned Income Tax Credit and Child Tax Credit for instance.

April 17 is the filing deadline for individual taxpayers.

According to UWSCC VITA program coordinator Mayela Moreno, last year VITA volunteers prepared 4,456 tax returns and helped taxpayers get nearly $3.4 million in Earned Income Tax Credits and $9 million in total refunds.

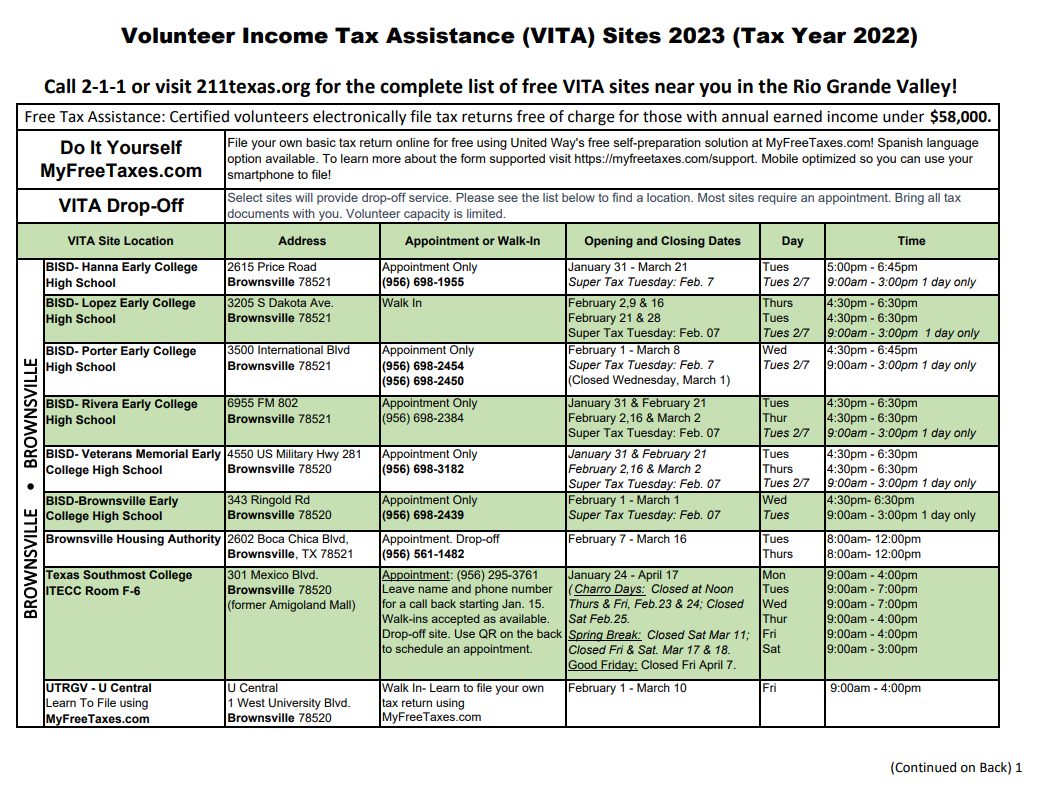

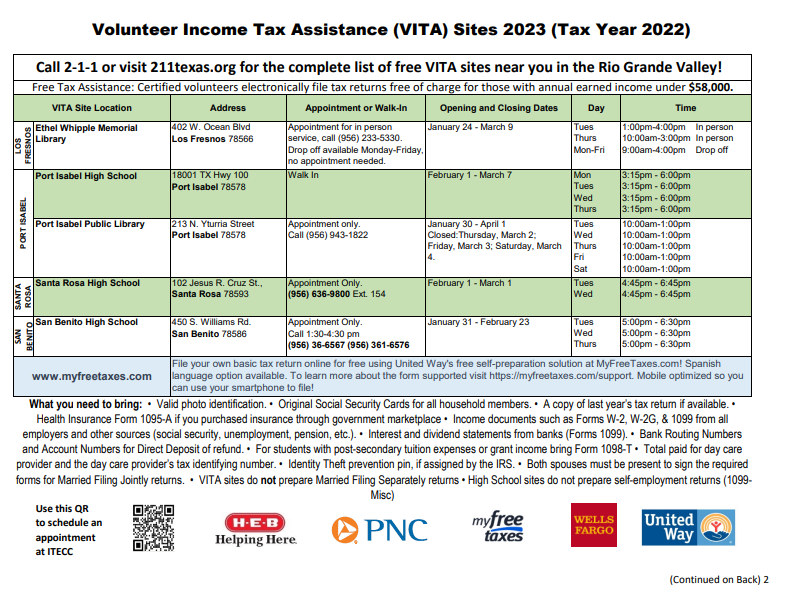

VITA sites will be available in Brownsville, Los Fresnos, Port Isabel, San Benito and Santa Rosa. Some are by appointment only. Others accept walk-ins.

For complete information and each site’s operating dates and hours and locations, download the schedule from unitedwayrgv.org.

Make sure and bring the following documents when meeting with a VITA volunteer: valid photo identification, original Social Security cards for all household members, a copy of last year’s tax return if available, health insurance From 1095-A if a family member purchases insurance through a government marketplace, and income documents such as Forms W-2, W-2G and 1099 from all employers and other sources such as Social Security, unemployment payments, pensions and such.

In addition, taxpayers seeking helping at a VITA site should bring with them interest and dividend statements from banks (Form 1099) and bank routing numbers and account numbers for direct deposit of refunds, total amount paid for daycare providers and the provider’s tax-identification number, the taxpayers identity-theft-prevention Personal Identification Number (PIN) if the IRS has provided one.

For students with post-secondary tuition expenses or grant income, make sure to bring Form 1098-T.

Both spouses much be present to sign the required forms for Married Filing Jointly returns. VITA sites do not prepare Married Filing Separately returns. Also, VITA sites at high schools to do not prepare self-employment returns (1099-Misc.).

To find a free-tax-help VITA site in the Rio Grande Valley dial 211, visit 211texas.org, or unitedwayrgv.org.

To take advantage of drop-off service in Brownsville, call (956) 295-3761 to make an appointment with a VITA volunteer at the Texas Southmost College ITEC Center site.

To find free tax help at VITA sites near you in the Rio Grande Valley call the dialing code 2-1-1, visit 211texas.org or unitedwayrgv.org.

Taxpayers also have the option of filing their tax returns online at home with the myfreetaxes.com self-preparation service. Choose the “By Myself” option on the website homepage to answer basic questions for on your tax documents. Myfreetaxes.com also has a list of free tax forms that are supported and offers a help line.

Filers can check the status of their tax refunds after filing by visiting irs.gov/refunds.

UWSCC said the VITA project would not be possible each year without volunteers at community sites such as Hanna, Lopez, Porter, Rivera, Veterans and Brownsville Early College high schools in Brownsville; the Housing Authority of the City of Brownsville, Ethel Whipple Memorial Library, Port Isabel High School, Port Isabel Public Library, San Benito High School, Santa Rosa High School, Texas Southmost College, UWSCC and the University of Texas Rio Grande Valley.

“United Way thanks the many volunteers and community agencies who (provide) VITA services this year,” Moreno said.

Here the complete information of each VITA site’s operating dates and hours and locations across Cameron County: