The city of McAllen adopted its tax rate this week for the 2021-22 fiscal year. The approved rate of 0.495600 per $100 of valuation is the same rate the city had last year, but homeowners will still end up paying more in property taxes. The city tried to explain why.

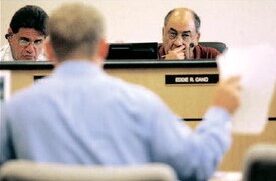

One thing that Mayor Javier Villalobos emphasized during a city commission meeting Monday was that the city was not raising taxes. Technically that is true, but how much residents end up paying is really determined by two moving parts.

THE APPRAISAL DISTRICT

The first is the Hidalgo County Appraisal District, which assesses the values of homes.

Despite its name, the appraisal district is not associated with the county but is a state entity that was created by the state legislature in 1991, according to Jorge Gonzalez, assistant chief appraiser for the Hidalgo County Appraisal District.

“Our sole job is to actually appraise every parcel in our county at market value as of Jan. 1 of every year,” Gonzalez said. “So what we do is we measure the market.

Their office of 95 employees covers 340,000 parcels and about 1,500 square miles in the county.

“We have a team of analysts who measure the market and see what it’s doing,” he said.

It’s a simple process, according to Gonzalez, though one challenge is that the state of Texas is not a disclosure state, meaning homeowners do not have to tell the appraisal district how much they paid for their home.

“So we have to measure the market based on whatever means possible out there,” Gonzalez said.

The office might send out optional surveys, refer to sites like Zillow, or refer to deeds which are recorded at the county courthouse.

If property owners disagree with the appraisal of their property, they can protest the value to the appraisal district’s appraisal review board. They can do so by filling out protest forms that are available on the appraisal district’s website.

“The unfortunate thing is, in our field, because what we do affects your taxes, for the most part, people don’t want to pay more taxes so they want the value to be lower,” Gonzalez said.

As an example, he explained that a home might be valued at $150,000 but the homeowner might petition to maintain the previous year’s value of $120,000.

Gonzalez explained they couldn’t leave the value at the lower level because the homeowner was already establishing the market at $150,000 and their neighbors were, more or less, also at that same level.

“ And it’s only because of the taxes,” he said of why residents may attempt to fight the new value.

After the appraisal district makes its assessments, it must send those new values to the cities, school districts, and other taxing entities by July 25 every year.

THE TAXING ENTITIES

After the appraisal district finishes assessing property values, taxing entities such as the county, cities and school districts begin working with the Hidalgo County Tax Assessor and Collector to determine how much revenue will be brought in by setting certain property tax rates, or ad valorem tax rates.

Elected officials who vote on the final tax rate for the fiscal year are typically presented with the following options:

>> Proposed tax rate: the rate the city is proposing to adopt for the upcoming year;

>> No-new revenue tax rate: the rate that will bring in the same amount of revenue as the current year;

>> Voter approval tax rate: the highest rate they can adopt before holding an election;

Because property values are likely to increase every year, the no-new revenue tax rate is usually going to be lower than the current rate.

In other words, even if the rate remains the same, property owners will pay more because the property is worth more and the taxing entities will receive more in property tax revenue.

Such was the case for the city of McAllen, prompting Villalobos to explain that, per state statute, the city had to issue a notice that taxes were increasing even though the rate was staying the same.

Revenues from the property tax rate are split into two funds — maintenance and operations (M&O) and the interest and sinking (I&S).

M&O funds are used to fund the general operations of the city while the I&S, also known as the debt service, are used to pay off debt that was accrued to finance facilities.

“So if we lower the tax rate, we’re actually even kind of, really, tightening our screws to the budget in terms of what we can do for that given year,” said McAllen City Commissioner Joaquin “J.J.” Zamora. “If we’re talking about the addition of three additional police officers, the addition of two additional fire personnel, the addition of a proposed new fire station, we are required by statute, if I’m not mistaken, to have a certain percentage dedicated to both. And if we lower the tax rate, then we’re really putting ourselves in a bind.”

“This growth is going to continue in the very foreseeable three, next four years and we already have projects that are lined up that need to be taken care of,” Zamora added. “If we don’t maintain that tax rate, unfortunately we have to go out to do either a certificate of obligation or even a general revenue bond to support some of your city services.”