The United Way of Southern Cameron County’s free Volunteer Income Tax Assistance program in Cameron County has been extended in response to the IRS extending the deadline to file and pay 2020 taxes to May 17, though the IRS is giving filers with Texas addresses until June 15 to pay and file taxes due to the February winter storm.

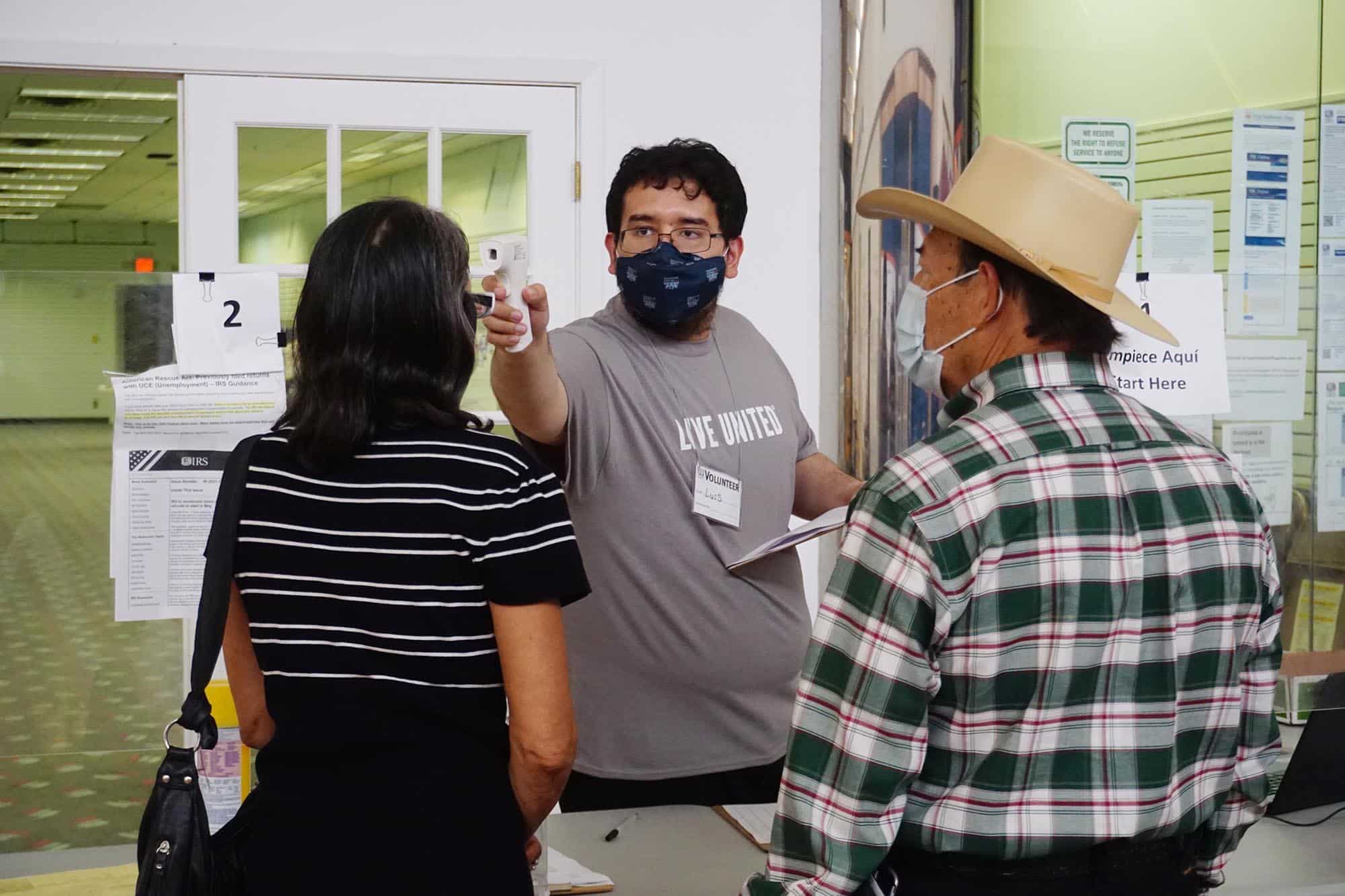

While assistance has been extended, only one physical VITA site remains open, at the Texas Southmost College ITEC Center, 301 Mexico Blvd. in Brownsville. Rather than sitting down at a table with a tax preparer as in past years, clients must call to make an appointment to drop off their tax documents, and will be contact by the preparer via phone. The ITEC site will be open through May 14. Clients must wear a mask and follow safety instructions.

There are other options, such as GetYourRefund.org, an online portal in its second year as a pilot program, with United Way as a participant, said UWSCC Financial Stability Coordinator Keren Arista.

“It’s a platform developed specifically for VITA programs nationwide,” she said. “It’s a case-management system that can be completely virtual, remote.”

Clients must register at GetYourRefund.org to use the service, which has also been used by Come Dream Come Build (formerly Community Development Corporation of Brownsville) to offer virtual assistance since the start of tax season. Clients upload the necessary tax documents to the site via computer or smart phone, and will be contacted by a VITA volunteer tax preparer.

The VITA assistance through GetYourRefund.org and the ITEC drop-off site and GetYourRefund.org is free for filers with simple tax returns and annual income under $57,000. GetYourRefund.org will be available through June 15, though Arista said filers who opt for the online service should get started no fewer than 10 days before the June 15 deadline for Texas filers.

“That’s not the kind of interface where you can go the last day and get served,” she said.

The simplest option, though, is MyFreeTaxes.com, a service available through Oct. 15, Arista said.

“If someone has an email account and can manage the English, it’s the easiest way to do your tax return this year,” she said. “You don’t have to go anywhere, you can stay home, you don’t have to upload documents to an online portal and sign with DocuSign. Just get on there and choose the self-preparation option. It takes you to the exact same software that we use at the VITA sites.”

MyFreeTaxes.com, courtesy of United Way, can handle most basic tax returns, does not have income or age limits, and provides filers with a help line, Arista said.

“MyFreeTaxes is a really good option,” she said.

VITA is funded by grants from Brownsville Foundation for Health and Education, H-E-B, the IRS, Prosperity Now, Wells Fargo and United Way. Arista said the pandemic threw a wrench in VITA’s usual operations.

“This was such a crazy year with COVID,” she said. “Forty percent of our normal sites had to close because their host facilities would not allow them to participate because of COVID restrictions. Then half of the remaining 60 percent chose not to do anything in person, but they were allowed to participate. Usually you go you sit with the volunteer tax preparer, you have that wonderful back and forth, and we just could not do that this year because of COVID.”